B2B Data Prospecting Guide: How to Find More Leads

Learn how B2B data prospecting helps you identify, qualify, and engage the right buyers using fresh signals instead of outdated lists.

Published

Dec 31, 2025

Written by

Chris P.

Reviewed by

Nithish A.

Read time

7

minutes

B2B data prospecting is how sales teams identify and qualify potential buyers before they enter the pipeline. The process has become more difficult to execute as buyers conduct more independent research before engaging with vendors. HubSpot reports that 96% of prospects research companies and products before contacting a sales representative. By the time outreach happens, buyers already have context, expectations, and shortlists. This raises the bar for outbound outreach to be relevant and well-timed.

When prospecting relies on outdated lists or one-off searches, you spend more effort maintaining data than engaging real opportunities. Signals are often detected after the opportunity to engage has already passed.

This guide breaks down a practical workflow for B2B data prospecting, showing how you can generate leads more consistently and where modern data infrastructure fits when prospecting needs to keep pace with market change.

What is B2B Prospecting?

B2B prospecting is the process of identifying potential buyers who are not yet in your pipeline and determining whether they are worth engaging. It comes after the go-to-market (GTM) strategy and before outreach begins. Done well, it creates a steady flow of new leads you can act on without constant rework.

Prospecting is often confused with list building. Lists are a byproduct of prospecting, not the objective itself. The real work is deciding who qualifies as a lead right now based on their role, company fit, and buying signals. When those inputs are unclear or inconsistent, prospecting output becomes unreliable.

It also differs from demand generation. Demand generation focuses on capturing interest from known audiences over time. Prospecting focuses on discovering the right people before they raise their hand. That difference affects data freshness, outreach timing, and follow-up priorities.

In practice, B2B prospecting combines clear targeting rules with a way to find new leads as conditions change. Without both, you end up reacting to the market instead of staying ahead of it.

The Goal of B2B Prospecting: Consistent Lead Creation

The goal of B2B prospecting is to create a steady supply of leads that sales teams can work with, without second-guessing relevance or timing.

You can measure prospecting by asking:

How many accounts were added?

How many contacts were pulled?

How many emails were sent?

Effective prospecting focuses on consistency. New leads should enter your system regularly, meet clear qualification criteria, and reflect the current buying context. That only happens when you tie prospecting to defined rules and updated inputs, not one-off searches.

When prospecting works, you spend less time validating data and more time engaging the right people.

Common B2B Prospecting Methods and Their Limits

Most B2B teams rely on a small set of prospecting approaches. Each can work in isolation but has limits once you try to generate leads consistently. Below are the three most common approaches and where they break down.

List-based prospecting: Teams build or buy lists of contacts and work through them over time. This is simple to start, but lists age quickly. Roles change, companies evolve, and prospecting effort shifts toward data cleaning rather than finding new leads.

Account-based prospecting: Prospecting starts with a defined set of target accounts and expands inward to find relevant contacts. This approach aligns well with account-based intelligence strategies. It breaks down when account lists aren't kept current or when role changes go unnoticed.

Trigger or signal-based prospecting: Teams look for events such as hiring activity, role changes, or company growth to identify new opportunities. This improves timing, especially when tied to live employee data, but it is harder to run consistently without a way to monitor changes over time.

You can use a mix of these methods, but running them manually causes lists to fall behind, signals to get detected late, and prospecting to become reactive.

Step-by-Step Guide to B2B Data Prospecting

A reliable B2B data prospecting process is structured, sequential, and repeatable. Each step builds on the previous one and reduces unnecessary data handling. When the workflow is explicit, you can generate more leads with less rework and maintain consistency as volume increases.

Below is a comprehensive breakdown of how to approach B2B prospecting.

Step 1: Define Who You Want to Prospect

Prospecting starts with knowing who you're looking for. This includes both firmographic data and role-based criteria that describe who is relevant and who is not.

Define two things: the companies you want to target and the people inside those companies who make buying decisions.

Company criteria to document:

Industry and market segment

Company size (employee count or revenue range)

Location and geography

Growth stage (startup, growth, enterprise)

Funding status or financial health

Technology they already use

Role criteria to document:

Job titles that influence or approve purchases

Department and function

Seniority level

Decision-making authority

Here’s an example of an ICP definition:

Company: B2B SaaS, 50-500 employees, raised Series A or later

Geography: North America

Role: VP Sales, Director of Sales Operations, Revenue Operations Manager

Exclusions: Competitors, existing customers, companies with no recent hiring or funding

This level of detail prevents wasted effort on poor-fit leads. It also keeps your target wide enough to maintain volume.

Step 2: Find Companies That Match Your Criteria

Once you know who you're looking for, find the companies where those people work. This step creates the boundary for all future prospecting. Most teams start with a static list. The problem is that lists go stale. Companies grow, shrink, get acquired, or change focus. A list built six months ago no longer reflects reality.

A better approach is to define company criteria that can be re-run as conditions change. This keeps your target account list current without manual updates.

This table shows the key company signals to track:

Signal | Why It Matters | When to Monitor |

Headcount growth | Companies growing fast often have a budget for new tools | Ongoing |

Recent funding (Series A-C) | Fresh budget and pressure to deploy capital | 3-12 months post-raise |

Tech stack match | Shows product fit and understanding of the problem | Immediate |

Hiring spike (3+ roles) | Team expansion signals need for new tools | Within 2 weeks |

Product launch or expansion | Indicates new priorities and budget shifts | Within 2 weeks |

Example: Find B2B SaaS companies with:

100-500 employees

Raised Series B in the last 12 months

Using Salesforce and HubSpot

Hiring for sales roles (3+ open positions)

Located in the US

This creates a focused list of companies where your product fits, and timing is good.

Step 3: Identify the Right People Inside Those Companies

Once target companies are defined, prospecting shifts to identifying the individuals who matter within those organizations.

Accuracy at this step is critical. Within prospecting, you should prioritize:

Current role and title: Job titles change. Make sure the person still holds the role you're targeting. Someone promoted six months ago may no longer be the right contact.

Decision-making authority: Understand who influences, who recommends, and who approves. These are different people with different priorities.

Active employment: People change jobs constantly. Verify they still work at the target company before reaching out.

Decision makers are different from influencers. Decision-makers have budget authority. They approve purchases but may not use the product daily. Influencers, on the other hand, use the product but don't control the budget. They can champion your solution internally. Champions are those who actively advocate for your product inside the organization, whether they're decision-makers or influencers.

For enterprise deals, start with decision-makers. For product-led growth, start with influencers who will push adoption from within.

Don't just search "VP of Sales." Also search:

Vice President of Sales

VP, Sales

Head of Sales

Chief Revenue Officer

SVP of Revenue

Job titles vary by company. Cast a wide net on titles but stay tight on function and seniority.

Step 4: Use Signals to Find New Leads Over Time

Most teams search for leads once and move on. That shows who fits today, but it misses people who become qualified next week or next month.

High-performing prospecting also capture who becomes relevant tomorrow.

This requires monitoring changes that create new opportunities, such as:

Individuals starting new roles that match the target criteria. A new VP of Sales joins a Series B company in your target market. They're likely evaluating tools and haven't locked into existing vendors yet. Reach out immediately after their start date.

Companies opening roles tied to your product or service. A company posts three Sales Operations Manager positions in one month, indicating they're scaling their sales team and will need tools to support that growth. Act within two weeks of the posting.

Organizational growth that signals a budget or operational change. A company announces a new office in a different region or launches a second product line, both signaling expansion and new budget allocation. The best window is 3-6 months after the announcement.

These events often indicate increased receptivity and better timing for outreach.

Step 5: Enrich Leads Only After They Qualify

Data enrichment should be applied selectively. Enriching every discovered profile increases cost and complexity because many leads will never reach outreach or scoring.

Gartner reports that poor data quality costs organizations an average of $12.9 million annually. Much of this comes from enriching contacts who never convert, wasting budget on data that becomes stale before it's used.

Pulling full data before qualification adds fields that are not used and makes prospecting workflows harder to maintain. If only 10% of discovered leads eventually get contacted, enriching all 100% means you're paying 10 times more than necessary.

A better approach is to enrich in stages based on what you need and when. Here’s a quick overview of what it entails.

Enrichment Stage | What to Pull | When to Do It | Cost Level |

Employment validation | Is this person still at the company? | Always, before anything else | Low |

Contact details | Email address, phone number | After initial qualification | Medium |

Full profile | Work history, education, social profiles | Right before outreach | High |

Intent signals | Web activity, content engagement | High-value accounts only | Highest |

For instance, you discover 5,000 contacts matching your ICP. Employment validation costs pennies per record and eliminates contacts who already moved companies. After applying qualification filters based on signals, you narrow to 800 high-priority leads. Enriching contact details for 800 costs significantly less than enriching all 5,000 upfront. When 200 of those 800 enter active sequences, you pull full profiles just for those.

This staged approach reduces enrichment costs while improving data accuracy because you're enriching closer to the moment of outreach.

Step 6: Send Leads Into Systems That Act on Them

Qualified and enriched leads need to reach the people or systems that will act on them. Delays between discovery and action kill conversion because timing matters.

Automated routing ensures leads move directly into your systems without sitting in spreadsheets or waiting for manual uploads. Leads should flow into:

CRM platforms like Salesforce or HubSpot where reps work them

Outbound sequencing tools like Outreach or SalesLoft that automate email and call sequences

AI SDRs that act on leads without human intervention

Route leads based on account size and signal strength. Enterprise accounts with high-intent signals like new executives, recent funding, or hiring spikes go to senior reps for same-day contact. Mid-market accounts with weaker signals go to standard queues for follow-up within 48 hours. Leads that fit your ICP but show no immediate buying signals enter nurture sequences for later engagement.

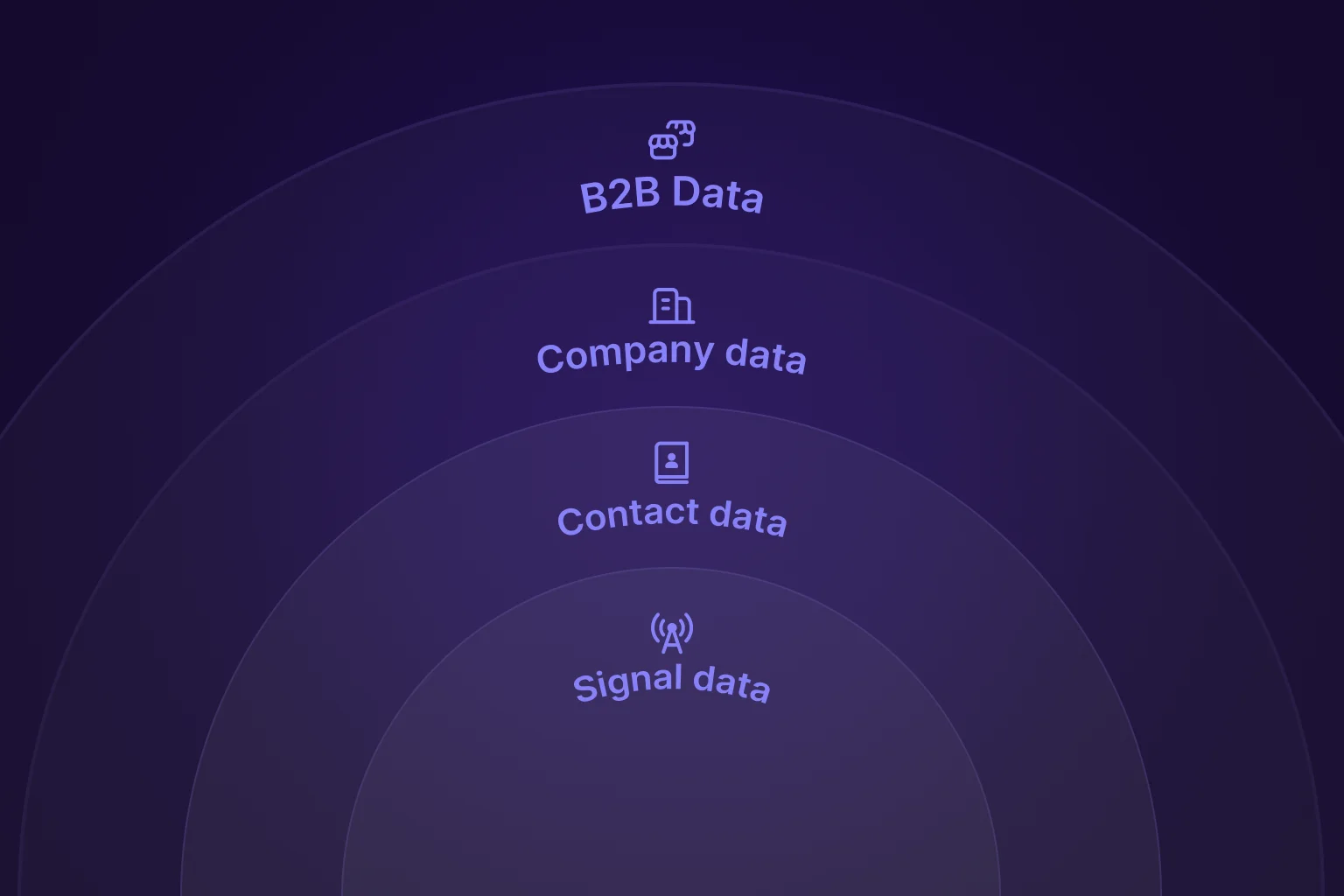

How Crustdata Fits Into B2B Prospecting Workflows

Crustdata sits underneath prospecting workflows as a data layer, not a UI-driven prospecting tool. You can use it to supply fresh inputs into the systems where prospecting happens, such as CRMs, outbound platforms, and internal automation.

In practice, you can combine multiple Crustdata APIs depending on how you source and qualify leads:

People and Company APIs let you search for leads by job title, seniority, company size, industry, location, and growth signals. Run the same search criteria repeatedly as data updates.

Watcher APIs monitor your target accounts and alert you when something changes. Get notified when someone starts a new role, when companies begin hiring, or when other buying signals appear.

People Enrichment APIs add contact details and profile data to specific leads after they qualify. Pull email addresses, phone numbers, work history, and social profiles on demand instead of enriching entire lists upfront.

Web Search API finds companies and signals that don't exist in standard databases yet. Discover businesses through competitor mentions, emerging product launches, or niche industry keywords across the web.

This setup allows you to blend structured discovery with external signals without breaking your workflow. Leads discovered through web search can be validated, enriched, and routed using the same pipelines as leads sourced through people or company filters.

Compared to static data providers, the advantage is control. Prospecting logic stays explicit, queryable, and reusable. Data flows into downstream systems as conditions change, rather than aging in exported lists. This makes lead generation easier to maintain as volume, channels, and targeting complexity increase.

Turn Prospecting Into a Repeatable Source of Leads

B2B prospecting works best when it is treated as an ongoing process rather than a series of campaigns. One-off tactics can create short bursts of activity, but they rarely hold up as teams grow or markets shift.

Consistency matters more than novelty. Clear targeting rules, repeatable discovery, and timely updates do more to sustain lead flow than any single tool or tactic. When those pieces are in place, prospecting becomes easier to manage and easier to evaluate.

If prospecting results feel unpredictable, it is often a sign that the data layer deserves a closer look. Evaluating how discovery and enrichment are handled can reveal where friction and decay are entering the workflow.

Book a demo to see how Crustdata supports B2B prospecting workflows designed to generate new leads consistently.

FAQs

How often should B2B prospecting criteria be revisited?

Prospecting criteria should be reviewed whenever the go-to-market focus changes, such as a new segment, pricing shift, or expansion into a different buyer persona. Outside of those moments, well-defined criteria can remain stable if the underlying data updates continuously.

What signals are most reliable for identifying new B2B leads?

Role changes, new hires tied to a buying function, team growth, and company-level expansion signals tend to be the most reliable. These events indicate both relevance and timing, which is critical for outbound success.

Can prospecting workflows support both sales teams and automation?

Yes. When discovery and qualification are expressed as queries rather than manual lists, the same outputs can feed human sales teams, AI SDRs, and scoring systems without separate processes.

How should I balance coverage versus precision in prospecting?

Coverage should come from consistent discovery, not broader filters. Precision comes from explicit qualification rules. Expanding scope without tightening criteria usually increases noise rather than lead volume that converts.

Products

Popular Use Cases

Competitor Comparisons

95 Third Street, 2nd Floor, San Francisco,

California 94103, United States of America

© 2026 Crustdata Inc.

Products

Popular Use Cases

Competitor Comparisons

95 Third Street, 2nd Floor, San Francisco,

California 94103, United States of America

© 2025 CrustData Inc.

Products

Popular Use Cases

95 Third Street, 2nd Floor, San Francisco,

California 94103, United States of America

© 2025 CrustData Inc.